How to Exchange Money in Cuevas in Argentina at the Blue Dollar Rate (2026 Guide)

💡 TL;DR:

Though they come with some risk, cuevas offer foreigners unregulated access to Argentina’s blue dollar rate, which is almost always the best value for large cash exchanges. But with exchange rates converging and WanderWallet offering similar rates legally through QR payments and RedATM withdrawals, they’re best seen as a secondary option for foreigners in 2025.

Cuevas, or informal exchange houses, have been a fixture of Argentina’s financial landscape for decades. For locals, they offer unregulated access to dollars. For foreigners, they provide reliable access to the blue dollar rate without the fees and limits tied to most legal exchange channels.

But cuevas come with tradeoffs. Because they operate informally, there’s no oversight or protection if something goes wrong. Most transactions also remain cash-based, which adds risk and inconvenience at a time when Argentina is rapidly shifting toward QR code payments.

This guide explains how relevant cuevas remain in 2025, how to navigate an exchange safely, and how to decide if/when they make sense to use as a complement to or replacement for modern alternatives like WanderWallet.

How Relevant Are Cuevas in 2025?

Recent developments are reshaping the role of cuevas in Argentina’s economy:

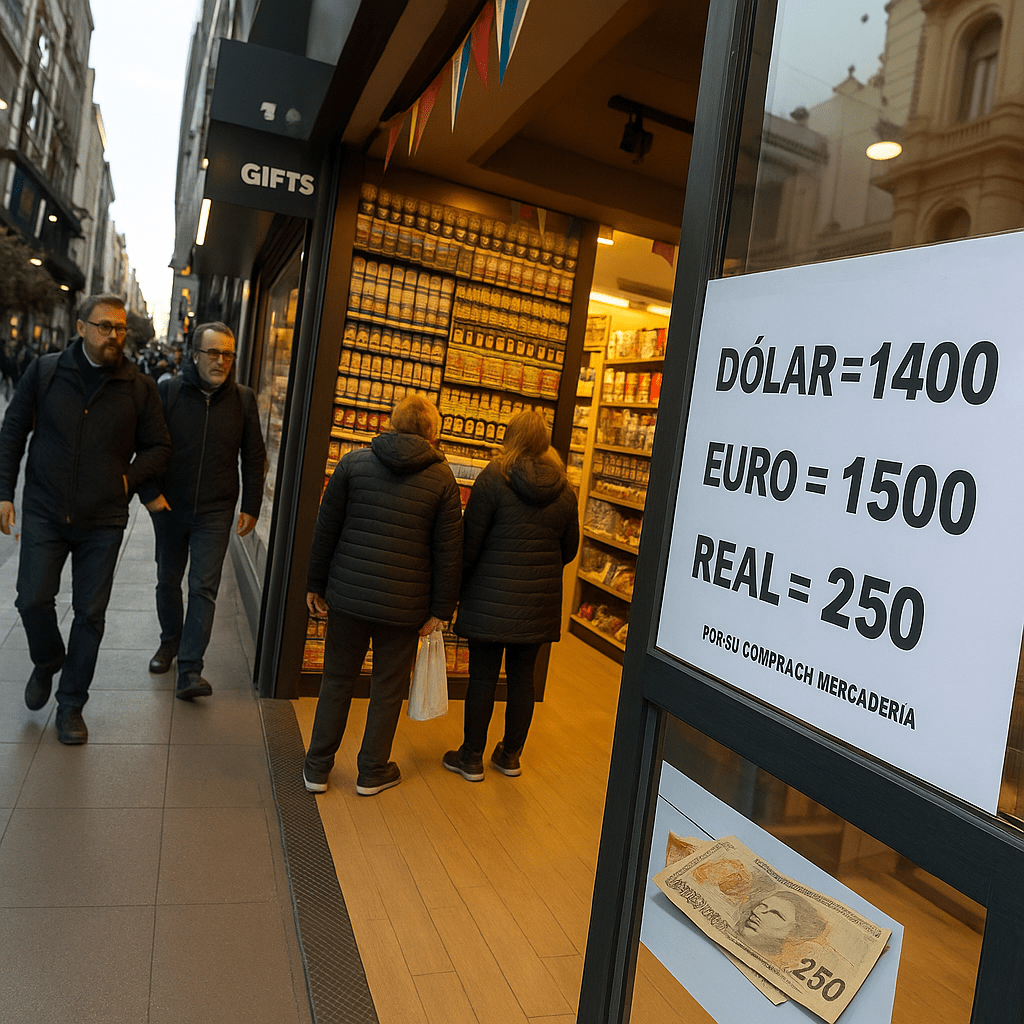

- The gap between the official and blue dollar rates has mostly closed.

- Transactions are moving rapidly toward QR payments.

- Services like WanderWallet now offer foreigners equivalent or better rates legally through QR transactions and RedATM withdrawals.

Still, cuevas haven’t disappeared. Some have modernized to incorporate Wise, PayPal, or USDT in addition to cash, and they remain a key outlet for locals who face strict limits on formal currency exchanges. Argentina also hasn’t gone fully digital – restaurant tips, small purchases, and occasional cash-only transactions are still part of daily life.

For foreigners, cuevas can still be useful when rates swing sharply or when a large cash withdrawal makes sense. But overall, the combination of rate convergence and legal digital alternatives like WanderWallet has made them far less essential for foreigners than they once were.

Safety and Legality

Cuevas operate in a legal gray area. They aren’t officially licensed, but have long been tolerated as an open secret in Argentina’s parallel currency market. Exchanging money there isn’t a crime for individuals, but transactions fall outside any formal protection. In other words, if something goes wrong, you’re on your own.

Most cuevas are discreet, professional, and conduct thousands of exchanges daily, but risk still exists. Counterfeit bills, scams, and theft occasionally occur, especially in unverified locations.

For safety:

- Go by personal referral or trusted local recommendation.

- Exchange during the day, in a secure location.

- Test with a small amount before exchanging larger sums.

- Keep transactions low-profile. Avoid street changers (arbolitos) unless directed to a legitimate office.

Used cautiously, cuevas can be efficient and safe enough for experienced travelers, but they always carry an element of risk that legal digital alternatives like WanderWallet avoid entirely.

When It Makes Sense to Exchange at a Cueva in Argentina

As a foreigner, a cueva is worth considering in a few specific situations:

- The blue dollar rate happens to be meaningfully higher than the WanderWallet rate. Check current rates at La Nación and on the WanderWallet home page. Typically the blue rate will stand below WanderWallet’s, but it’s always healthy to check and assess options.

- You need to make a large withdrawal in cash.

For example, if your landlord can’t provide a QR code and requests your rent in cash. (RedATMs can still sometimes handle large withdrawals, but limits vary.) - You already brought U.S. dollars to Argentina.

Cuevas only offer top rates when you’re exchanging physical dollars in high denominations and in good condition. - You have a trusted recommendation.

Reputation and word of mouth matter, never walk into one blindly.

Otherwise, if the WanderWallet rate is similar to or higher than the blue dollar (as in November 2025), it’s usually better to skip cuevas altogether. WanderWallet provides near-blue-dollar value legally, digitally, and without handling cash.

Cuevas can be used as a complement to WanderWallet for the small cash reserve you should keep for restaurant tips and cash-only transactions. However, RedATM withdrawals are generally an easier and safer option.

| Scenario | Best Option | Explanation |

|---|---|---|

| WanderWallet rate is higher or equivalent to Blue Dollar (as in November 2025) | WanderWallet | Equal or better rate + full convenience. |

| Blue Dollar exceeds WanderWallet by < 3% | WanderWallet | For most, not having to carry large amounts of cash is worth the minor difference in rates. |

| Blue Dollar exceeds WanderWallet by > 3-5% | Cueva | Significant value gain for exchanging large amounts of USD. |

💡 TL;DR:

Cuevas make sense only when the blue rate is clearly stronger than WanderWallet. Otherwise, WanderWallet QR payments are your best option for most transactions, and RedATMs are sufficient for the small amount of cash you need.

How to Exchange Money at a Cueva

- Find a reputable cueva.

Ask trusted locals, other travelers, or expat forums. Avoid street changers shouting “cambio.” - Check the daily blue dollar rate.

Confirm it on a reliable source such as La Nación – Dólar Hoy or BlueDollar.net. Expect some negotiation—rates can vary slightly depending on the amount and type of bills you bring. - Know your alternatives.

A few cuevas now handle transfers through Wise, PayPal, or USDT, though rates are usually adjusted to offset their own costs. It helps to know the Western Union post-fee rate for context before agreeing. - Bring crisp U.S. dollars if possible.

$50 and $100 bills in clean, untorn condition get the best rate. Euros are often accepted but at a discount. - Agree on the amount and rate up front.

Confirm everything clearly before handing over cash or initiating a transfer. - Count your pesos before leaving.

Do this discreetly, ideally inside the office, and make sure denominations match what was agreed. - Store cash securely.

Keep only what you need for daily use and stash the rest in a safe place.

💡 TL;DR:

Exchange clean U.S. bills only, verify the daily blue dollar rate to guide negotiation, and avoid dealing with unverified street exchangers.

References and Resources

- BlueDollar.net – Tracks live blue dollar, MEP, and official exchange rates in Argentina (Updated 2025)

- La Nación – Dólar Hoy – Daily official, MEP, and blue dollar rates from one of Argentina’s leading newspapers

Frequently Asked Questions

Is it legal to use a cueva?

Not officially, but it’s tolerated. Millions of locals use them daily.

Is it safe to use a cueva?

Generally yes if you use a reputable office during daytime and handle cash discreetly.

How can I find a trustworthy cueva?

Ask locals, hotel staff, or expat communities. Never follow street “cambio” hawkers.

What kind of bills should I bring?

$50 and $100 USD notes in perfect condition. Older, marked, or small bills get worse rates.

Can I exchange euros?

Yes, but rates are weaker. U.S. dollars are preferred.

About the Author

Gabriel Otero

Gabriel is the co-founder of WanderWallet. Proudly Argentinian and based in Brazil, he brings years of experience in the payment processing industry to building seamless local payment access for travelers across Latin America.