Argentina Payments Cheat Sheet 2026

A simple guide for travelers, nomads and long stay foreigners who want to understand how money works and how to pay in Argentina.

If you have spent even a few hours in Argentina, you have probably heard at least one confusing phrase: “Can you pay me by Alias?”, “Do you have QR?”, “The dollar rate today is… complicated”, “We only take transfers”.

Plus the eternal mix of dólar blue, dólar MEP, cash, QR codes, SUBE cards, colectivos, cuevas, CBU, CVU, Alias, card rejections and taxi surprises.

This guide is the clear, friendly reference you wish you had on day one. It explains how payments, transport and everyday transactions work in Argentina in 2026 and how WanderWallet connects foreigners to the same rails locals actually use.

Table of Contents

- Payment Methods in Argentina

- Understanding CBU, CVU and Alias

- Transport Payments

- How Delivery Apps Work

- Exchange Rates Explained

- What WanderWallet Gives You

- Cheat Sheet to Screenshot

TL;DR

Argentina runs on QR payments, bank and wallet Alias transfers, and increasingly QR based public transportation. Cash still exists but foreign card ATM withdrawals are expensive. WanderWallet lets foreigners scan and pay QRs, withdraw cash cheaply, and soon send Alias transfers without needing an Argentine bank account.

Payment Methods in Argentina

Understanding payment culture in Argentina is key. Here is what locals actually use, in real order.

QR Payments – the number one way to pay

QRs dominate daily life. Restaurants, cafés, taxis, kiosks, salons, supermarkets and even street vendors display QR codes. Payment clears in seconds.

Why QRs matter:

- Cheaper for merchants

- Instant confirmation

- Universal across wallets and banks

Where WanderWallet fits: WanderWallet lets foreigners scan and pay any interoperable QR (Mercado Pago, MODO, bank QRs) without needing an Argentine wallet or bank account.

Cards – reliable but not perfect

Foreign cards work in many places but have limitations:

- Some merchants add surcharges

- Certain stores refuse foreign cards entirely

- Cards fail more during network congestion

- Businesses often prefer QR for lower fees

Cash – still necessary sometimes

Cash is still used in:

- Small kiosks

- Markets and ferias

- Informal services

- Events (football matches, concerts)

- P2P transactions

ATM warning: Foreign card withdrawals are expensive and use weak rates.

WanderWallet solves it: Withdraw pesos through Red ATM at much lower cost. Read our Red ATM withdrawal guide.

Understanding CBU, CVU and Alias

CBU

The traditional 22 digit bank account number used by Argentine banks.

CVU

The virtual wallet equivalent, used by fintech apps like Mercado Pago and Ualá.

Alias

A human readable shortcut to a CBU or CVU. Example: cafe.palermo.verde.

Why Alias matters:

- Instant transfers

- No need to share long numbers

- Works across banks and wallets

Alias used for merchant payments

Although designed for personal transfers, many merchants now accept Alias as a workaround for receiving payments quickly.

WanderWallet roadmap

WanderWallet will soon support Alias transfers to CBU, CVU or Alias so foreigners can pay locals just like residents do.

Transport Payments in 2026

SUBE Card

Still used for buses, metro and trains, but slowly being replaced.

New payment options

Argentina is rolling out:

- QR payments in public transport

- NFC tap payments

- Debit and credit card acceptance at turnstiles

SUBE may not be required anymore at some point in 2026.

Ride Apps

- Uber

- Cabify

- DiDi

Taxis

Taxis use a taxímetro. If you do not know the city well, you can be overcharged.

Recommendation: Use ride apps unless necessary.

Navigation Tools

- Google Maps

- Moovit

- Como llego

How Delivery Apps Work

PedidosYa

Widest delivery network for food and essentials.

Rappi

Strong in major neighborhoods. Works well for restaurants and supermarkets.

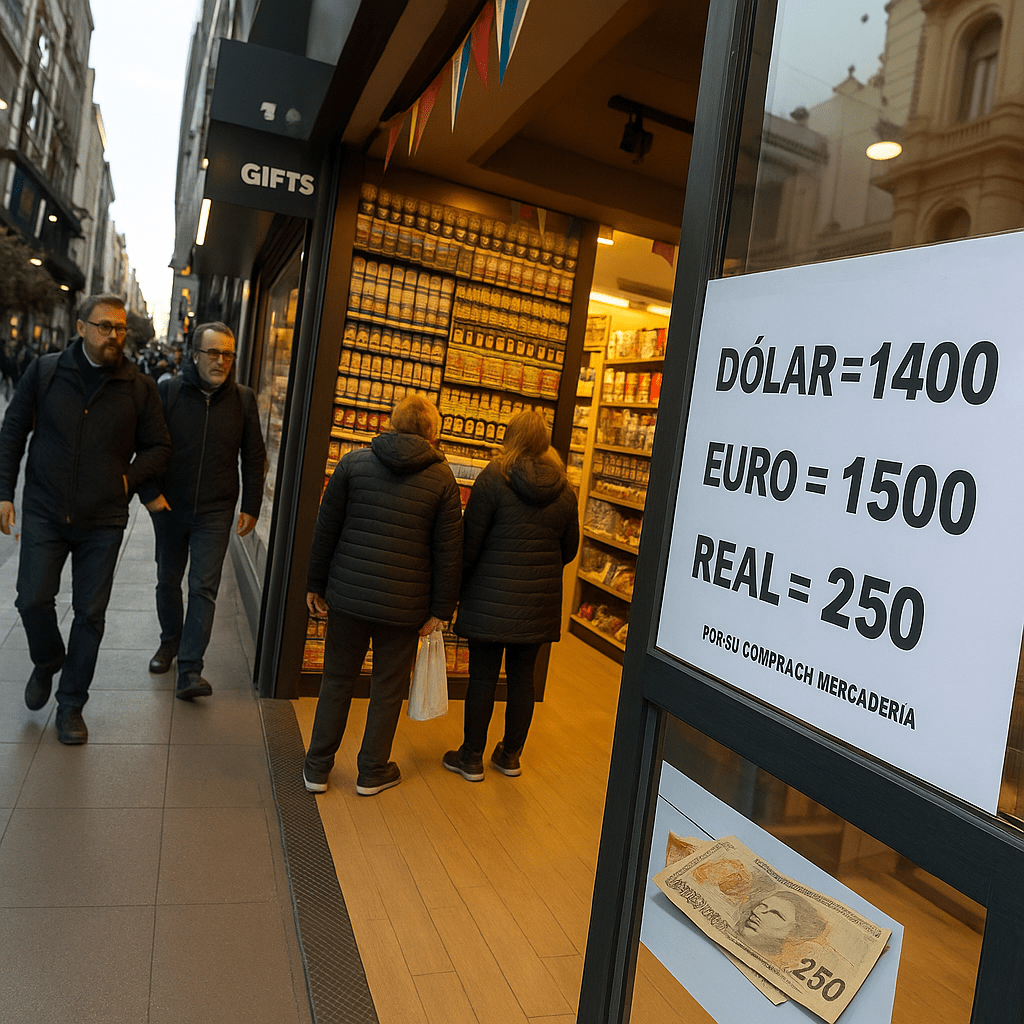

Exchange Rates Explained

Official Dollar

Lowest rate but now closer to the more competitive ones (compared to previous years). Not relevant for day to day spending.

Blue Dollar

Informal cash market rate.

MEP Dollar

Legal, real market-driven rate. Closest to true value.

Where WanderWallet sits

WanderWallet uses a value in the range of MEP and blue and sometimes even higher depending on market conditions. The live rate is always visible in-app and on the website.

What WanderWallet Gives You

WanderWallet allows foreigners to:

- Scan and pay QRs everywhere

- Withdraw pesos through Red ATM cheaply

- Top up via ACH, SEPA, Revolut or USDC

Coming soon:

- Alias transfers to CBU, CVU or Alias

Cheat Sheet to Screenshot

How to Pay in Argentina

- QR first

- Cards second

- Cash last

Transport Basics

- SUBE still works

- QR and card payments expanding fast

- Uber, DiDi and Cabify recommended

- Avoid taxis unless needed

Rates

- Official weak

- Blue informal

- MEP real market

- WanderWallet sits around MEP and blue

Essential Apps

- Uber, Cabify, DiDi

- PedidosYa, Rappi

- Google Maps, Moovit

- WanderWallet

Frequently Asked Questions

What payment methods work in Argentina for tourists in 2026?

QR payments are the best option — they work everywhere and give you the best exchange rate. Cards work but often at the official rate (worse). Cash is still needed for some situations like markets and taxis.

Do I need a DNI to use Mercado Pago in Argentina?

Yes, Mercado Pago requires Argentine ID (DNI). Foreigners without DNI can use WanderWallet instead, which lets you scan and pay all the same QR codes without needing local documentation.

What is the blue dollar rate in Argentina?

The blue dollar is the informal street rate, typically 20-40% higher than the official rate. WanderWallet gives you rates in the range of MEP and blue dollar, so you get real market value for your money.

Can I use my credit card everywhere in Argentina?

Most restaurants and shops accept cards, but you will get the official exchange rate which is significantly worse. Many smaller vendors, markets, and taxis are cash or QR only.

How do QR payments work in Argentina?

Open your payment app, scan the merchant QR code, confirm the amount, and the payment is instant. With WanderWallet, you see the exact USD cost before confirming. Works at restaurants, shops, supermarkets, and even street vendors.

About the Author

Gabriel Otero

Gabriel is the co-founder of WanderWallet. Proudly Argentinian and based in Brazil, he brings years of experience in the payment processing industry to building seamless local payment access for travelers across Latin America.