How Foreigners Can Make Payments and Withdraw Cash in Argentina (2026 Guide)

Behind Argentina’s easy charm lies a financial system that can frustrate even experienced travelers. When making payments in Argentina, foreign tourists and nomads deal with multiple exchange rates, limited card acceptance, expensive ATMs.

Fast-growing QR systems like Mercado Pago are dominating local commerce now, but they usually require a local bank account. On top of that, policy changes and market swings mean what works one month may not work the next.

This guide is a living document that explains the best available options for foreigners to make payments and withdraw cash in Argentina in 2025. It compares cards, cash, QR options, and the pros and cons of ATMs, cuevas, and Western Union.

It also explains how WanderWallet gives foreigners access to Mercado Pago and low-cost cash withdrawals, easing many of the usual pain points.

Table of Contents

- Understanding Argentina’s Payment Landscape

- How to Balance Cards, Cash, and QR Payments in Argentina

- Comparing Payment Options

- How to Withdraw and Exchange Cash (5 Options)

- How to Pay Rent

- Future Outlook

- References and Resources

- FAQ

Understanding Argentina’s Payment Landscape

A quick background on Argentina’s unusual exchange rate system, its emerging QR payment network, and what it means for foreigners:

Why Does Argentina Have So Many Exchange Rates?

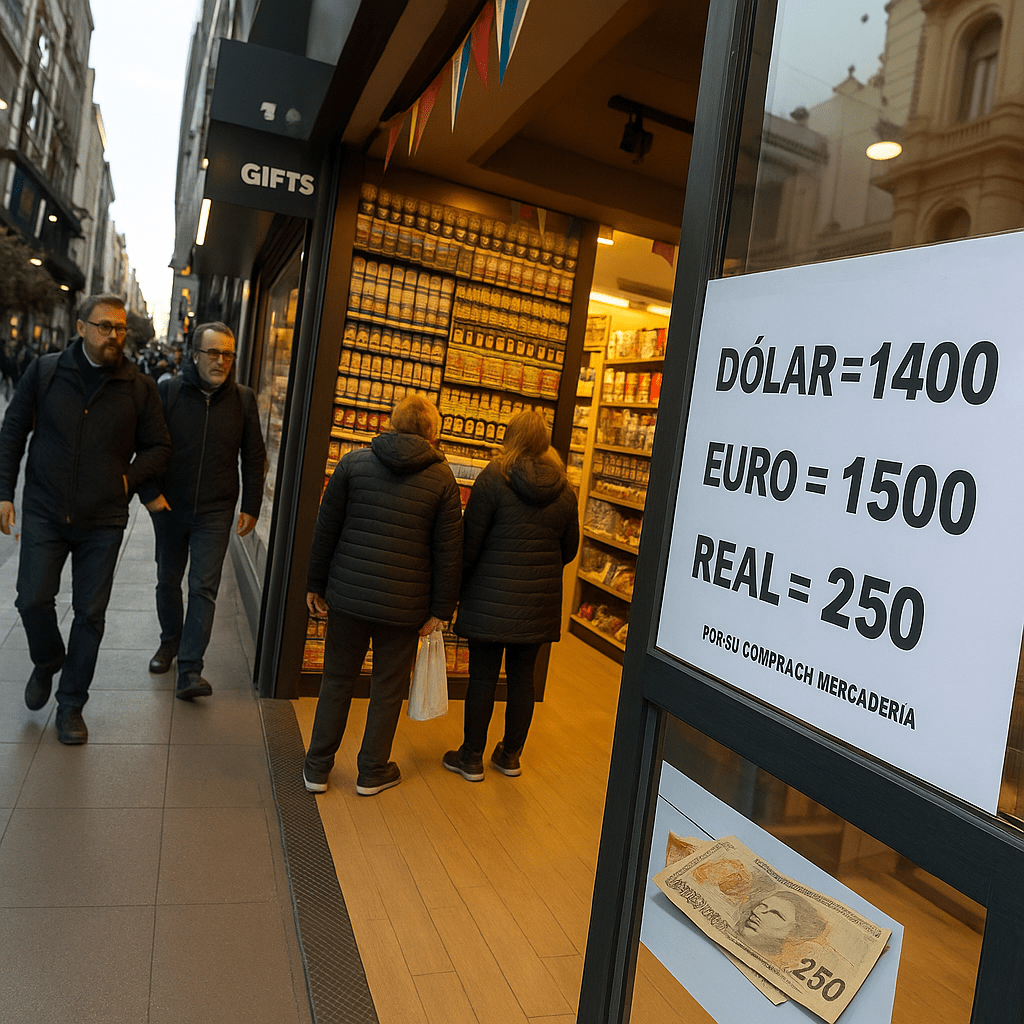

Currency controls limit how many dollars Argentines can buy, so unofficial exchange mechanisms emerged. The blue dollar (street rate) is typically 20-40% better than the official bank rate.

The Argentine peso has a long history of instability, with repeated cycles of high inflation and currency controls. To protect their savings, many Argentines prefer to hold U.S. dollars. But this is difficult to do legitimately, since the government has tight limits on how many dollars residents can buy or transfer.

Over time, several unofficial exchange mechanisms emerged to get around these restrictions. Each has different levels of legality, convenience, and value relative to the government-controlled rate. Today, nearly every Argentine participates in some form of non-official exchange, and it’s not considered “underground” behavior.

Rates to Know

Official rate: The government-set exchange rate used by banks and subject to restrictions. It’s consistently the weakest rate for foreigners buying pesos.

Blue dollar (dólar blue): The informal cash-exchange rate used outside the banking system. Often the highest value for your dollar, but requires negotiation and exchanging physical cash.

MEP rate (“foreign tourist” rate): The reference rate used for most foreign credit card purchases (and some ATM withdrawals). After card-network conversions and bank fees are applied, the rate you receive is usually a few percentage points lower than the official MEP rate. It’s legal, convenient, and generally within a few percentage points of the blue dollar, often higher.

WanderWallet rate: WanderWallet operates on cryptocurrency rails with its own real-time exchange rate. It typically tracks very close to the blue dollar and the MEP rate, and often provides better value than both.

💡 How do rates normally compare?

Typically: Blue > MEP > Official. The WanderWallet rate usually tracks close above the blue dollar – sometimes slightly higher, sometimes slightly lower.

As of November 2025, WanderWallet offers the best value, but all major rates are within a few percentage points of each other.

💡 Where can I check current rates?

You can monitor the blue, MEP, and official rates at La Nación – Dólar Hoy, and the live WanderWallet rate here.

The Rise of QR Code Payments in Argentina

In recent years, Argentina has rapidly shifted from a cash- to QR-based economy. More than half of all transactions now happen through QR networks like Mercado Pago and Modo, which merchants prefer to credit cards because of lower fees and instant settlement.

Unfortunately for foreigners, these QR networks typically require an Argentine bank account. And with many merchants still hesitant to accept credit cards, this leaves cash as the main fallback for most travelers.

WanderWallet bridges this gap. For many foreigners (especially non-South American nationals), it’s the only solution for direct access to local QR networks.

💡 TL;DR:

QR payments are now the default of payments in Argentina. For most foreigners, these QR networks are only accessible with WanderWallet.

How to Balance Cards, Cash, and QR Payments

Use QR payments (via WanderWallet) as your primary method for best rates. Keep cards as backup. Carry small cash for places that don’t accept digital payments.

In Argentina, no single payment method covers every situation. Cards aren’t always accepted. Cash only works for in-person payments, and can be inconvenient to withdraw and carry. QR payments with WanderWallet are ideal for everyday use, but don’t cover every scenario.

This section looks at the advantages, drawbacks, and considerations for each option so you can decide what mix works best for you.

Comparing Payment Options in Argentina (2025)

| Method | Main Advantages | Key Drawbacks |

|---|---|---|

| Credit / Debit Cards | – Convenient and familiar – Accepted in most larger restaurants and businesses |

– Not accepted by many smaller merchants – Can’t be used for restaurant tips – Unpredictable declines are common – Applied rate is almost always below the blue dollar |

| Cash | – Universally accepted – Required for tips – Blue dollar is often the best rate for foreigners |

– Inconvenient to constantly withdraw – Withdrawals often give low-denomination bills – Quickly loses value when inflation is high – Safety concerns |

| QR Payments with WanderWallet | – Accepted almost everywhere – Convenient scan-and-go payments – Usually a better value than the MEP rate, and blue dollar |

– Requires internet connection – Can’t be used for restaurant tips – Limited ability to make online payments |

💡 TL;DR:

– Cards and QR payments are more convenient ways to pay, and save you the time, inconvenience, and safety risks of withdrawing and carrying cash.

– Cash and QR payments are much more widely accepted, and generally give better value for your dollar than cards.

Choosing the Right Balance

The most important thing to consider is where exchange rates currently stand. Usually, the best available rate is either the WanderWallet rate or the blue dollar, with the MEP a few percentage points behind both.

When the WanderWallet rate is strongest

As it currently stands in November 2025, there are no tradeoffs to make – QR payments are your most valuable and your most convenient option.

- Recommended balance: Use WanderWallet as your default payment option, use credit cards for online payments when no QR code is available, and keep a small cash reserve for restaurant tips and emergencies.

When the blue dollar is strongest

Then you have to factor your personal preference for convenience vs. value.

- Recommended balance when the rates differ by a few percentage points: Stick with WanderWallet as your default for every day purchases to avoid the hassle of dealing with stacks of small bills. Plan ahead and use cash for larger purchases where the margin is more noticeable.

- Recommended balance when the rates differ by 5% or more (rare but possible): Shift more of your purchases to cash, with WanderWallet as a backup when you don’t have exact change.

💡 TL;DR:

WanderWallet is the easiest and most practical way of paying in most cases. For extra comfort, always carry at least enough cash for tips and a card with no foreign transaction fees ready for online purchases that don’t provide QR codes.

How to Withdraw and Exchange Cash (5 Options)

Your best options are: 1) WanderWallet QR withdrawal at Link ATMs, 2) Cuevas (informal exchange houses), 3) Western Union, 4) Bank ATMs (worst rates + high fees), 5) Airport exchange (avoid).

No matter how long you plan to stay in Argentina, you’ll need some amount of cash. Foreigners have five main options for receiving pesos: RedATMs, standard ATMs, Western Union, casas de cambio, and cuevas. Each comes with trade-offs in cost, convenience, and security.

Comparing Cash Withdrawal Options in Argentina (2025)

| Option | Rate Applied | Pros | Cons | Best For |

|---|---|---|---|---|

| RedATMs (with WanderWallet) | WanderWallet rate | Low fees, easy to find, transparent | Needs internet, has limits | WanderWallet users. |

| Standard ATMs (cards) | Official rate or MEP | Easy to find and familiar | High fees, low limits, rejected often | Emergency withdrawals |

| Western Union | Near blue rate | Strong rates, no need for cash, legitimate company. | High fees after 1st payment, lines. Branches run out of cash or give low denomination | Travelers looking to withdraw a high amount of cash in 1 operation |

| Casas de cambio | Variable, between official and blue | Legal, regulated an fast. | Requires physical EUR/USD, bad rates, commissions | Travelers with foreign cash preferring official channels |

| Cuevas | Blue dollar | Often good value, immediate cash. | Requires cash, negotiating in Spanish.

Technically illegal, safety considerations |

Travelers carrying foreign cash who want to maximize value |

Step-by-Step Guides

- How to Withdraw Cash from ATMs in Argentina for less than $1 in Fees →

- How to Withdraw Cash at Western Union in Argentina →

Choosing the Right Option

The main considerations before making a withdrawal or exchange are:

- How do the blue dollar and WanderWallet rate compare?

- How much money do you need?

- Do you have foreign cash (USD or EUR) with you?

- What is your comfort level with exchanging at a cueva?

When the WanderWallet rate is strong (as in November 2025), the best balance of value and convenience is to withdraw from a RedATM. It delivers a near-blue or better rate for less than $1 USD with fast and transparent transactions.

If the blue dollar outpaces WanderWallet by more than a few percentage points and you want to hold more cash, two options offer the best return:

- Cuevas – highest value, but requires physical USD/EUR and negotiation, and is technically illegal.

- Western Union – very high value on your first withdrawal, and doesn’t require physical cash. However, high fees on future withdrawals usually cancel out any exchange rate advantages.

In general, try to avoid standard ATMs and casas de cambio – they reliably provide the lowest value no matter where exchange rates stand.

💡 TL;DR:

– If the WanderWallet rate and blue dollar are close, use RedATMs.

– If the blue dollar is more than a few percentage points higher, then evaluate convenience vs cost, and exchange through a Western Union office for the amount of cash you’ll spend.

How to Pay Rent in Argentina

If you’re a nomad staying in Argentina longer than a typical visit, you’ll often find better deals by renting directly instead of through Airbnb. The catch is that most landlords expect bank transfers from Argentine tenants, and may hesitate to rent to you unless you can pay using one of the following methods:

Cash

If a bank transfer isn’t an option, many landlords will request rent in cash, and you’ll need to withdraw (or exchange) pesos using one of the methods above.

International transfers (ex. Xoom, Wise)

Some landlords will accept transfers to local or foreign accounts via money transfer services. Although more convenient than withdrawing cash, these transfers require full banking details, typically use weak exchange rates, and charge higher fees. Payments can also be delayed or blocked depending on local banking controls.

WanderWallet

If your landlord accepts QR codes through Mercado Pago or another local wallet, WanderWallet lets you instantly pay rent in pesos from your balance. There’s no cash to handle or high transfer fees, and the rate usually matches or beats the blue-dollar rate.

💡 TL;DR:

If your landlord accepts QR payments, use WanderWallet for instant payment at a competitive rate with minimal fees. If not, pay in cash using the best available rate for withdrawals/exchanges. Use international transfers only when required.

Future Outlook

Argentina’s payment system is moving steadily toward a digital-first future. QR codes have become part of daily life, and wallets like Mercado Pago and Modo keep expanding their reach. At the same time, many Argentines are shifting from physical dollars to stablecoins such as USDC and USDT, creating a natural link between local payments and global digital currencies.

Exchange-rate policies will continue to change, but parallel markets like the blue dollar are unlikely to disappear soon. The long-term trend is clear: less cash, more interoperability, and faster digital transactions.

💡 What’s next

Argentina is heading toward a cash-light economy built around QR and digital dollars. WanderWallet sits at the center of this shift, letting foreigners move funds instantly, access strong exchange rates, and pay like locals without relying on cash or Western Union.

References and Resources

- BlueDollar.net – Tracks live blue dollar, MEP, and official exchange rates in Argentina (Updated 2025)

- La Nación – Dólar Hoy – Daily official, MEP, and blue dollar rates from one of Argentina’s leading newspapers

- BAExpats.org – Buenos Aires expat forum where locals and foreigners share up-to-date experiences with exchange rates, ATMs, and money transfers

- LandingPadBA – Money in Argentina – Explanation of rates, ATM withdrawals, and payment methods

For real-time rates check our live USD to ARS value (updated every hour) and compare to BlueDollar.net or La Nación – Dólar Hoy. For practical tips and current on-the-ground updates, LandingPadBA and BAExpats.org are reliable community sources.

Related Guides

- QR Payments for Tourists – Scan and pay like a local

- Cuevas Exchange Guide – Blue dollar exchange explained

- Buenos Aires Cost of Living – Budget breakdown for foreigners

Frequently Asked Questions

Can I use my foreign credit card in Argentina?

Credit card acceptance is improving – especially in bigger cities like Buenos Aires – but many small businesses and local services still don’t take them. Even when accepted, prepaid cards like Wise, Monzo or Revolut can be declined unpredictably, and tips at restaurants always require cash.

Why do merchants prefer QR codes?

QR payments mean lower transaction fees, instant settlement, and less cash handling. For merchants, it’s safer and easier than dealing with large amounts of pesos.

Why do I need WanderWallet to make QR code payments?

For most foreigners (especially non-South American nationals), WanderWallet provides the only workaround for the major QR networks’ requirement of a local Argentinian bank account.

Why should I use WanderWallet at places that accept credit cards?

The WanderWallet rate is usually stronger than the MEP rate applied to foreign cards. The app also displays both the exchange rate and total cost in USD for full transparency on every transaction.

Should I bring foreign cash at all?

Though not strictly necessary, bringing some US dollars in cash is wise. Physical cash exchanges offer the good exchange rates when the blue dollar is strong, and having cash on hand is useful if you find yourself in a situation where neither cards or QRs are accepted.

Should I bring US dollars or euros?

US dollars are strongly preferred. They’re easier to exchange and consistently get better rates than euros. If you bring euros, you may find fewer exchange points and weaker rates.

Are Argentinian ATMs reliable?

Most ATMs in Argentina have high fees, low withdrawal limits, and poor exchange rates. They’ll often run out of cash and/or reject foreign cards. However, ATMs on the network known as RedATM offer competitive rates with lower fees and higher limits when used together with the WanderWallet app.

Is it safe to carry cash?

It’s generally safe if you’re cautious, especially in trendier neighborhoods of Buenos Aires like Palermo. However, it’s recommended to not carry large amounts at once. Use QR payments when possible to reduce how much cash you need. Keep extra cash stored securely and only carry what you need for the day.

About the Author

Dan Volgenau

Dan is a contributing writer for WanderWallet. He has lived in Latin America for five years, primarily in Buenos Aires, Argentina. He has a degree in Economics from Dartmouth College.