I Went to Bolivia with Zero Cash. I Didn’t Need It.

Hi, I’m Vojta, WanderWallet co-founder. We’re launching WanderWallet in Bolivia, and I wanted to share my first-hand experience of actually using it on the ground. I did something similar when we launched in Argentina (that story is here). Bolivia was a different beast. Here’s how it went.

TL;DR

I traveled to Bolivia right before our launch to test WanderWallet in real life. I arrived with zero cash and never needed it. Every hotel, restaurant, taxi, coffee shop, and even a dentist accepted QR payments. The exchange rate difference between paying with a foreign card (official rate: 6.96 BOB/USD) and paying with WanderWallet (~8.9 BOB/USD during my trip) meant I was saving around 28% on every single transaction. I did eventually take out some emergency cash from an ATM. Never touched it. Brought it home as a souvenir.

Why I Went

Right before we launched WanderWallet in Bolivia, I traveled to the country to get a feel for how things work on the ground. Not to read about it. Not to look at data. To actually live it, pay for things, and see what happens.

This matters because Bolivia is not Argentina. Argentina has a mature QR payment ecosystem and cards work almost everywhere. Bolivia felt like it could go either way. I needed to know if a foreigner could realistically go cashless here.

Turns out: yes. Very comfortably.

The Exchange Rate Difference Is Real

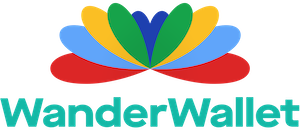

If you’re not familiar with Bolivia’s currency situation, here’s the short version. The official exchange rate is 6.96 bolivianos per dollar. It’s been frozen there since 2011. The parallel market rate fluctuates between 9 and 10. That’s a 30-40% gap. We did a deep dive here.

Your foreign credit card? It uses the official rate. ATMs? Official rate. WanderWallet? During my trip in early February 2026, I was consistently getting around 8.9 BOB per dollar. That’s roughly 28% better than what your Capital One or Revolut card would give you.

That difference sounds abstract until you’re paying for lunch and saving a couple of dollars every single meal. Over a week of everyday spending, it adds up fast.

Santa Cruz: Cards Not Welcome, QR Everywhere

I spent most of my time in Santa Cruz, which is Bolivia’s largest city. And here’s what surprised me: I saw places where cards were not accepted at all. Not small street stalls. Real businesses.

But QR? Everywhere. Literally everywhere.

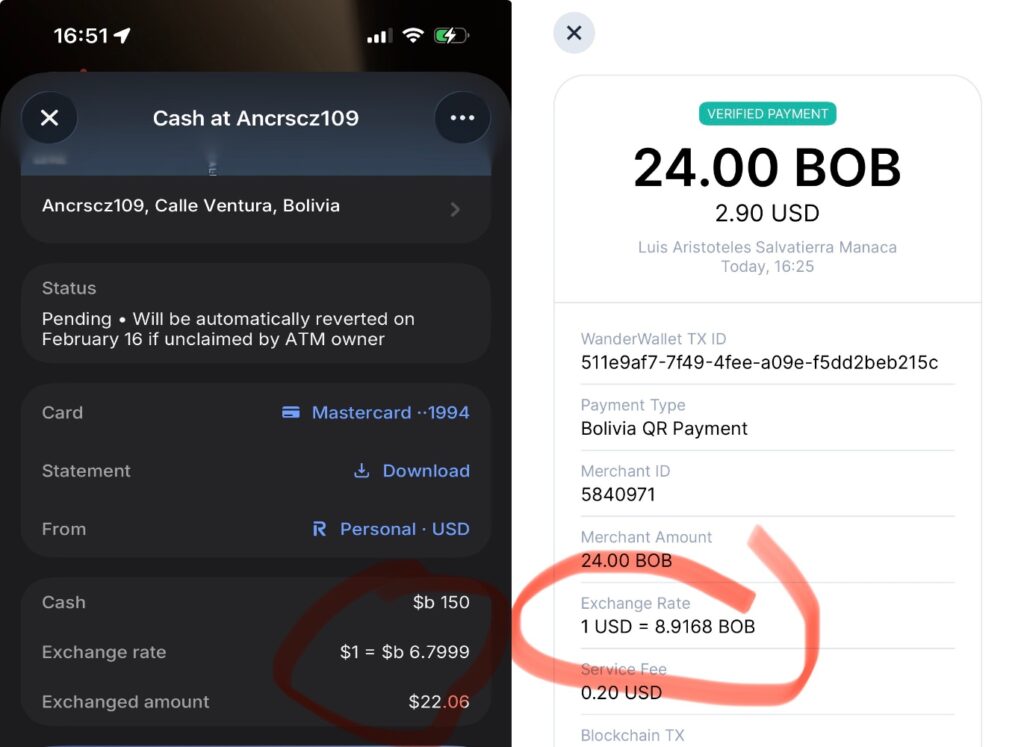

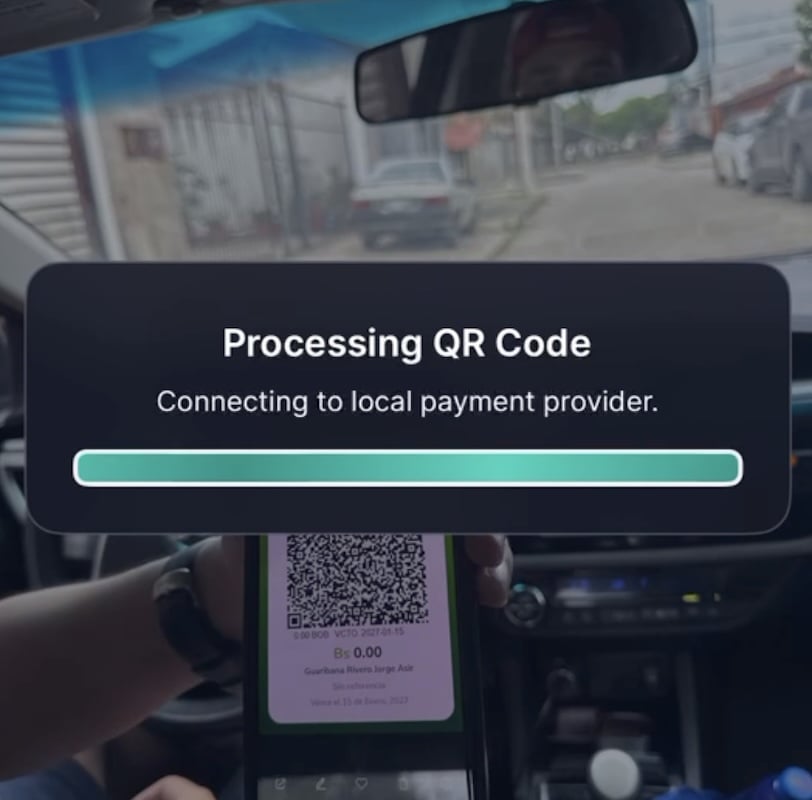

Most merchants already have the QR code printed out on the counter. You walk up, order your coffee, scan the QR while they’re making it, enter the amount, confirm. They bring your coffee, you show them the receipt on your screen. Done.

At restaurants, even smoother. You ask for the bill, mention you’re paying with QR, and they bring you the bill and the printed QR together. You pay right there at the table. I loved this flow.

Hotels: Where the Savings Really Hit

My hotel was booked through Booking.com at a dollar rate. When I checked in, they were happy to accept a USD payment based on the Booking quote. But I asked: what’s the price in bolivianos, and can I pay with QR?

They converted using the official rate. So I paid in bolivianos via WanderWallet at our much better exchange rate for the same room. The savings on that one transaction alone were significant.

If you’re staying multiple nights, this is where the math really starts working in your favor.

Every Restaurant, Every Meal

Every single restaurant I went to accepted QR payments. Not most. Every one.

And here’s a detail I liked: when I wanted to leave a tip for the waiter, the guy pulled out his own personal QR code. Printed. Laminated. That’s how widespread QR payments are in Bolivia. Even tips have gone digital.

Saving a couple of dollars on each meal doesn’t sound like much. But doing it three times a day for a week? That’s real money.

Getting Around: InDrive Over Uber

Uber exists in Bolivia, but InDrive is roughly half the price. And every single InDrive driver I rode with accepted QR payments.

Moving across the city for $4 with Uber, or $2 with InDrive? I know my answer.

Online Shopping: Yes, QR Works There Too

I ordered coffee online once, for pickup. The payment method? QR. You save the QR image to your camera roll, open WanderWallet, upload the image to the QR payment screen, and pay. Simple.

This was a small thing, but it made me realize how deep QR goes in Bolivia. It’s not just in-person. The entire payment culture runs on it.

The Everything Else Category

Self-service kiosk at a fast food chain? QR. Starbucks? QR. I even went to the dentist while I was there. A very nice clinic, by the way. Payment method? QR.

At some point I stopped being surprised and just expected it to work. It always did.

One Thing to Know: The Nightly Maintenance Window

There is one nuance about Bolivia’s QR Simple system worth mentioning. The payment rails are instant and run 24/7, but every bank does a reconciliation once a day, at night, where the systems go down briefly. With our payment partner, that window is around 11pm to midnight.

So carry some backup cash for late-night situations. We show a notice inside WanderWallet when this maintenance window is active, but it’s good to be aware of it.

The Emergency Cash I Never Used

I’ll be honest. I was the first person to use WanderWallet in Bolivia. I didn’t know what to expect. So I did take out some emergency cash from an ATM, just in case.

I never used a single bill. Brought it all home as a souvenir.

Why This Feels Better Than Cards

The payment experience in Bolivia is smooth. Genuinely smooth. Most of the time, the merchant has done the hard part for you: the QR is right there on the counter or on the receipt. You just scan, enter the amount, confirm, and show the receipt.

Yes, I’m paying with an app that we built, so there’s extra sentiment involved. But setting that aside, QR payments just feel better here than cards. There’s something about the directness of it. Scan, pay, done. No terminal rebooting, no “the machine isn’t working,” no wondering if your foreign card will get declined.

And then there’s the exchange rate. The fact that I’m saving around 28% on every transaction compared to what my no-foreign-fee Capital One credit card would charge? That’s not a minor detail. That’s a significant part of why this works so well.

Bolivia is ready for this. The infrastructure is already built. WanderWallet just lets you, as a foreigner, plug into it.

Frequently Asked Questions

Do I need a Bolivian bank account to pay with QR?

No. WanderWallet lets you pay any QR Simple merchant in Bolivia without a local bank account. You fund your wallet in USD or EUR and we handle the conversion.

What exchange rate does WanderWallet use in Bolivia?

During my trip in early February 2026, WanderWallet was consistently giving me around 8.9 BOB per dollar , roughly 28% better than the official rate of 6.96 that ATMs and foreign credit cards use. The parallel market rate fluctuates between 9 and 10, so WanderWallet lands very close to it, without the hassle of carrying cash.

Is QR payment really accepted everywhere in Bolivia?

In major cities like Santa Cruz, La Paz, and Cochabamba, yes. Restaurants, hotels, pharmacies, fast food kiosks, ride-hailing drivers, even dentists. Bolivia has one of the highest QR adoption rates in South America. You’ll want some backup cash for very remote areas or late-night situations during the maintenance window.

What's the nightly maintenance window?

Bolivia’s QR Simple system runs on instant payment rails that are up 24/7, but banks do a reconciliation once a day at night. With our partner, that’s roughly 11pm to midnight. During that window, QR payments may not go through. We show a notice in the app when it’s happening.

Should I still carry some cash?

I’d recommend having a small amount as backup, especially for late nights. But during my entire trip to Santa Cruz, I never needed the cash I withdrew. Every merchant I visited accepted QR.

How do I pay with a QR code from an online order?

Save the QR image to your camera roll, then open WanderWallet and upload it to the QR payment screen. It works the same as scanning a physical QR code.

About the Author

Vojta Pohunek

Vojta is the cofounder and CEO of WanderWallet. He is from Prague and has lived in Latin America for three years, where he focuses on making everyday payments simpler for anyone moving between countries.