Blue Dollar vs MEP Dollar: Argentina Exchange Rates Explained

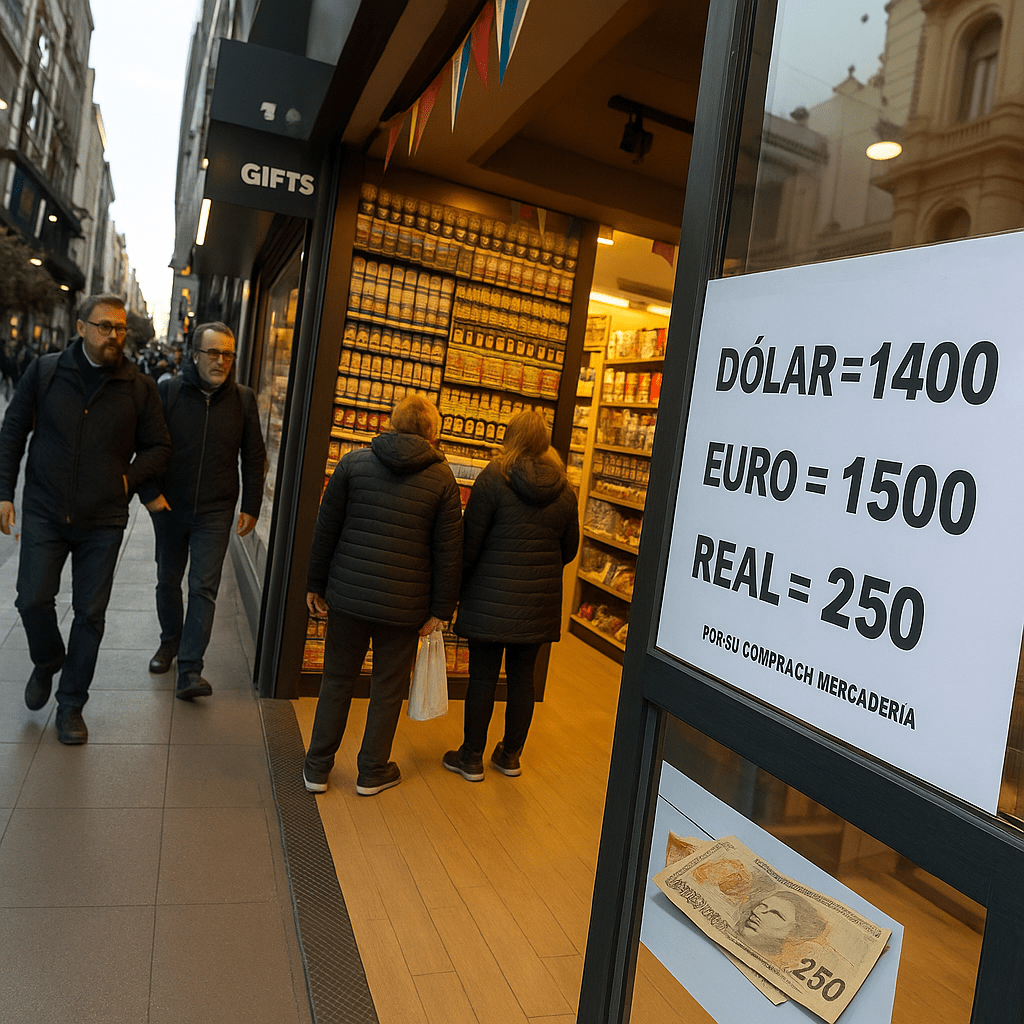

For years, Argentina’s currency system meant the same $100 bill could have wildly different values depending on where and how you exchanged it, thanks to official, blue, and MEP rates. That confusing multi-rate reality shaped travel and everyday spending.

Today, those distortions have largely disappeared.

TL;DR

- Official Rate: ~1,450 ARS per USD. Now tracks closely to parallel rates.

- Blue Dollar: Cash parallel market (~1,480-1,500 ARS). Historically offered huge advantages, now minimal.

- MEP Dollar: Legal rate for foreign Visa/Mastercard (~1,460 ARS). Essentially the same as Blue now.

- Dólar Cripto: Crypto-based rate used by WanderWallet (~1,520-1,550 ARS). Still 3-5% better.

Today in 2026, the gap between official, Blue, and MEP has almost completely collapsed. But Dólar Cripto still edges them out. The best approach is to use WanderWallet for QR payments and cash withdrawals (best rate), cards as backup.

Argentina restricted access to foreign currency through capital controls. Citizens could only legally buy $200 USD per month at the official rate, plus roughly 80% in taxes. This artificial restriction created parallel markets where the peso traded at its actual market value.

The result was four main exchange rates:

- Official Rate — Government-controlled, historically much lower than market value

- Blue Dollar (Dólar Blue) — Informal cash market rate

- MEP Dollar (Dólar MEP) — Legal rate from securities trading, applied to foreign cards

- Dólar Cripto — Crypto-based rate, typically the best available. Used by WanderWallet.

In 2023, understanding which rate you got meant the difference between a $1,500 trip and a $2,500 trip. Today? The gaps have mostly closed.

What is the Blue Dollar?

The Blue Dollar is Argentina’s unofficial, parallel market exchange rate. The name “blue” comes from Argentine slang for informal or underground dealings.

Here’s how it works:

- Cash-only transactions at informal exchange houses called cuevas (caves)

- Street changers on Calle Florida in Buenos Aires (called arbolitos—”little trees”—because they stand around like trees)

- Requires clean, post-2013 $100 USD bills in pristine condition

- Rates published daily on sites like dolarhoy.com

Historically, the Blue Dollar offered 50-100% more pesos per dollar than the official rate. If you visited Argentina in 2023 with $1,000 and used the wrong rate, you effectively lost $500 worth of purchasing power.

Today: The Blue Dollar still exists, but it’s only about 2-3% better than the official rate. The arbitrage opportunity that made cuevas essential has largely disappeared.

For a detailed guide on using cuevas, see our Cueva Exchange Guide.

What is the MEP Dollar?

The MEP Dollar stands for “Mercado Electrónico de Pagos” (Electronic Payment Market). It’s a legal, regulated rate derived from securities trading.

Since late 2022, Visa and Mastercard have applied the MEP rate to foreign card transactions in Argentina. This was a game-changer for tourists.

When you pay with a foreign credit or debit card:

- The merchant charges you in Argentine Pesos

- Visa/Mastercard converts using the MEP rate

- Your bank converts to your home currency

- You see the final charge in USD/EUR on your statement

No cash. No cuevas. No negotiations. The rate is applied automatically.

What is Dólar Cripto?

The Dólar Cripto is the exchange rate available through cryptocurrency markets. It’s consistently 3-5% better than MEP because crypto markets are more liquid and have lower spreads than traditional securities.

WanderWallet uses the Dólar Cripto rate for all Argentina payments. This means when you scan a QR code at a restaurant or shop, you’re getting the best available rate.

You don’t need to understand crypto to use it. Your balance stays in USD, and you see exactly what you’ll pay before confirming.

Current Rates: January 2026

| Rate Type | ARS per USD | When You Get It |

|---|---|---|

| Official (BNA) | ~1,450 | Banks, wire transfers |

| Blue Dollar | ~1,480-1,500 | Cash at cuevas/street |

| MEP Dollar | ~1,460 | Foreign Visa/Mastercard |

| Dólar Cripto | ~1,520-1,550 | WanderWallet QR payments + RedATM |

The key insight: Official, Blue, and MEP are now within 3% of each other. But Dólar Cripto still gives you 4-6% more pesos than cards or cash.

The Milei Effect: Why the Gap Collapsed

This wasn’t always the case. Here’s how the gap has evolved:

| Year | Gap Between Official and Blue |

|---|---|

| January 2023 | 100% (Blue was double official) |

| December 2023 | ~40% (post-Milei devaluation) |

| December 2024 | ~10% |

| January 2026 | ~3% |

When President Javier Milei took office in late 2023, he immediately devalued the peso and began lifting currency controls. The official rate jumped from 366 to 800 overnight, and has continued rising toward market rates ever since.

What this means for you: The old advice (“bring cash, find a cueva”) is now outdated. Cards work fine. But if you want the absolute best rate, WanderWallet’s Dólar Cripto still beats everything else by 3-5%.

Real Math: What Tourists Actually Pay

Let’s run the numbers on a realistic two-week trip with a $2,000 USD budget.

Scenario 1: Credit Card (MEP Rate)

- $2,000 × 1,460 = 2,920,000 ARS

Scenario 2: Blue Dollar (Cash)

- $2,000 × 1,490 = 2,980,000 ARS

- Savings vs cards: ~$40 USD equivalent

- Minus spread and hassle: essentially break-even

Scenario 3: Dólar Cripto (WanderWallet)

- $2,000 × 1,535 = 3,070,000 ARS

- Savings vs cards: ~$100 USD equivalent

- Savings vs cash: ~$60 USD equivalent

Bottom line: On a $2,000 trip, WanderWallet saves you $60-100 compared to other methods. Not life-changing, but it adds up.

Hidden Costs of Cash (Blue Dollar)

- Exchange house spread: 1-3% between buy/sell rates

- Smaller bill penalty: $20 and $50 bills get 3-5% worse rates

- Counterfeit risk: Fake peso notes circulate

- Safety risk: Carrying large cash amounts in a foreign city

- Logistics: Finding reliable cuevas outside Buenos Aires is difficult

Hidden Costs of Cards

- Foreign transaction fees: 1-3% depending on your card issuer

- Cash surcharges: Some small shops charge 10-15% extra for cards (illegal but common)

- Limited acceptance: Many vendors only take QR or cash

Need Cash? Use WanderWallet + RedATM

Here’s something most guides won’t tell you: you can withdraw physical pesos at better-than-blue-dollar rates using WanderWallet and RedATM terminals (found in Carrefour stores).

Here’s how it works:

- Find a RedATM terminal (look for them near Carrefour entrances)

- Enter the peso amount you want and press Enter

- The ATM displays a QR code

- Open WanderWallet, tap “Pay Now,” and scan the QR

- Review the USD cost, confirm, and collect your cash

Why this matters:

- Regular foreign card ATM: MEP rate, $10-12 fees, low limits (~$50-70 USD)

- WanderWallet + RedATM: Better-than-blue rate, under $1 total fees, limits up to $350 USD equivalent

This is the best way to get physical pesos in Argentina. You’re getting cueva-beating rates without the hassle or risk of informal exchanges.

For locations and full details, see our RedATM Cash Withdrawal Guide.

Your Payment Options Compared

| Method | Exchange Rate | Fees | Convenience | Best For |

|---|---|---|---|---|

| WanderWallet QR | Best (~1,535) | Transparent, low | High | Daily spending |

| WanderWallet + RedATM | Best (~1,535) | Under $1 | Medium | When you need cash |

| Credit Card (MEP) | Good (~1,460) | 0-3% FX fee | High | Hotels, restaurants |

| Blue Dollar (cash) | Good (~1,490) | 1-3% spread | Low | If you brought USD |

| Regular ATMs | MEP rate | High | Low | Emergencies only |

Where Cards Fall Short

Foreign cards work at most restaurants, hotels, and larger shops. But Argentina runs on QR payments—specifically Mercado Pago and MODO. Small vendors, street food, taxis, and neighborhood shops often only accept QR codes or cash.

If a vendor sees your foreign Visa, they might:

- Decline it (their terminal doesn’t handle international cards)

- Add a 10-15% surcharge (illegal but common)

- Tell you “efectivo” (cash only)

This is where QR payment apps become essential.

The Practical Recommendation

Here’s how to handle money in Argentina in 2026:

1. Use WanderWallet for QR payments (best rate)

Scan Mercado Pago and MODO QR codes everywhere. You get the Dólar Cripto rate, which is 4-6% better than cards or cash. This covers street vendors, taxis, cafés, and anywhere that displays a QR code.

2. Need cash? Use WanderWallet + RedATM

Find a RedATM in Carrefour or on the map we provide, enter your peso amount, scan the QR with WanderWallet. You get the same great rate with under $1 in fees and much higher limits than regular ATMs.

3. Use a no-foreign-fee credit card as backup

Visa and Mastercard get the MEP rate automatically. Good for hotels, nicer restaurants, and online bookings. The rate is now competitive.

4. Skip the cuevas

The arbitrage opportunity is basically gone. WanderWallet + RedATM gives you a better rate with zero risk.

Related Guides

- RedATM Cash Withdrawal Guide – Get cash at the best rate

- Cuevas Exchange Guide – How informal exchanges work (mostly outdated now)

- Argentina Payments Cheat Sheet 2026 – Complete guide to paying in Argentina

- Mercado Pago for Foreigners – QR payments without an Argentine ID

- QR Payments for Tourists – Scan and pay like a local

Frequently Asked Questions

What is the blue dollar in Argentina?

The blue dollar (dólar blue) is Argentina’s informal parallel market rate for cash USD, traded at unofficial exchange houses called cuevas. As of January 2026, it’s around 1,480-1,500 ARS per USD. While historically the best option, WanderWallet’s Dólar Cripto rate now often beats it.

What is the best exchange rate in Argentina for tourists?

The Dólar Cripto rate offers the best value in 2026, at around 1,520-1,550 ARS per USD. WanderWallet uses this rate for both QR payments and RedATM cash withdrawals, giving you 3-5% more pesos than credit cards or blue dollar cash.

How can I withdraw cash in Argentina without high fees?

Use WanderWallet with RedATM terminals (found in Carrefour stores). You scan a QR code, pay with your WanderWallet balance, and get cash at Dólar Cripto rates for under $1 in fees. Regular ATMs charge $10-12 with tiny limits.

What rate does my credit card get in Argentina?

Foreign Visa and Mastercard transactions use the MEP rate (around 1,460 ARS per USD). This is good but 3-5% worse than WanderWallet’s Dólar Cripto rate. Cards work for hotels and bigger purchases, but QR payments with WanderWallet give better value.

Should I bring cash to Argentina in 2026?

Bring $100-200 in clean $100 bills as emergency backup, but you no longer need to rely on cash. WanderWallet lets you pay by QR (best rate) and withdraw pesos from RedATM terminals for under $1 in fees. This beats hunting for cuevas.

What is RedATM and how does it work?

RedATM terminals let you withdraw cash using a QR code instead of a card. With WanderWallet, you get Dólar Cripto rates, under $1 in fees, and limits up to 500,000 ARS. Find them in Carrefour supermarkets. You enter the amount, scan the QR with the app, confirm, and collect your cash.

About the Author

Milo

Milo writes about the stuff nobody tells you before you land: why your card gets declined, where cash still rules, and how to actually pay for things without getting ripped off. He's WanderWallet's resident payment nerd.